🧠 Why You Shouldn't Want to Win March Madness

|

View Online | Sign Up | Advertise Welcome to Long-Term Mindset, the Wednesday newsletter that helps you invest better. Today's Issue Read Time: <3 minutes

Together with Limits Express Did you know you could make thousands of dollars a month selling brand-name products like Colgate toothpaste on Amazon? Limits Express is a company that will help you do just that. They completely manage your Amazon store for you, so you don’t have to do any of the work. They currently have over 100 clients making thousands of dollars every single month from Amazon stores that they completely manage for them. They bring on investors, potentially just like yourself, and pool their capital together to place large purchase orders, receive discounts from suppliers, and get the best pricing possible. As they spend more, the discounts get bigger! You supply the capital for inventory; they do the rest! They average a 25% monthly return on your inventory spend, so if you spend $10,000 on inventory, your store will profit roughly $2,500 that month! Visit their website and book a 30-minute Zoom call directly with Kyle, the company's co-founder. Ask him any questions and take a look at some of the clients' stores they manage!

Friends, In 2011, March Madness turned the betting world on its head. The Final Four included:

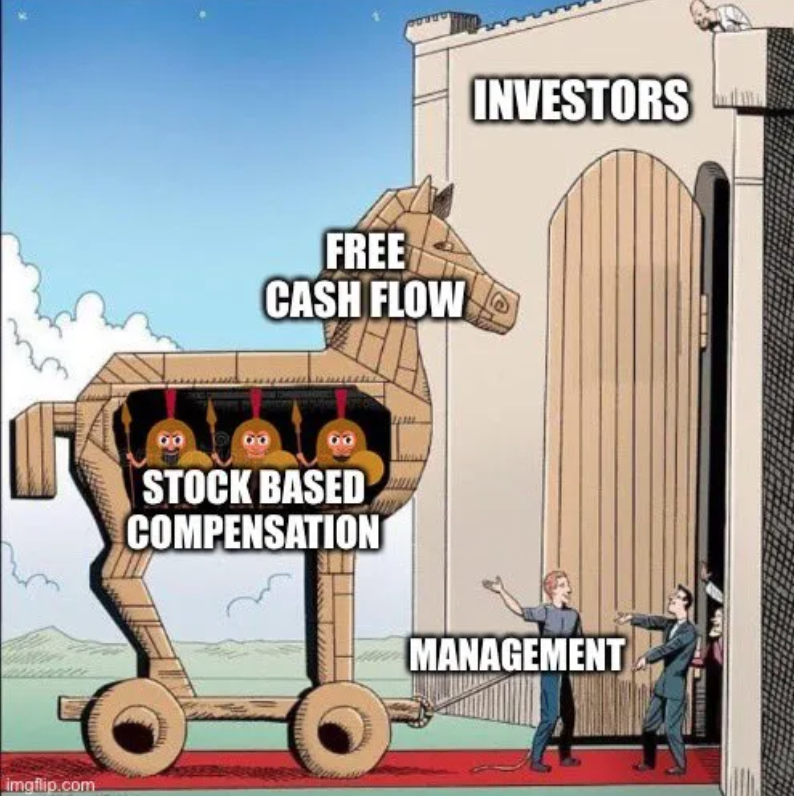

Of the 5.9 million brackets submitted to ESPN.com, only two correctly chose these participants. That's just 0.00003% of brackets submitted. (Note: The women's tournament has had outlier years -- like 2016 -- as well, but not to the same extreme) Here's the question: Would you put your money on these same two people to finish in the top 10% of brackets over the next decade? The correct answer: Absolutely not! These tournaments are inherently unpredictable -- a Cinderella team nearly always makes a deep run. That's what makes it so much fun. But accurately predicting who that Cinderella team will be every year is impossible. Don't get us wrong: seeing your portfolio up 300% in one year is very exciting. But the same types of investments that make this possible are the same that could just as easily lead to 90% drawdowns. Widen your lens, and it becomes a little less exciting -- and more predictable: between 1986 and 2021, the average Final Four participant was a #2 seed. And that includes the five times a #11 seed has reached the Final Four. Over this timeframe, the most consistently successful brackets stuck with mainstream choices. The implications are important. If you're investing for retirement, you (hopefully) have decades before you'll need to draw on it. What matters is NOT trying to get the highest possible returns in any given year. It's getting moderately healthy returns over your investing life. Notching 10% returns over 30 years is the same as 1,600% returns in total. Interestingly, most people miss an option when signing up for March Madness brackets -- the tiny "Autofill" feature that simply picks the best seed. Don't get us wrong -- we know this is the antithesis of having fun in March. But at the same time, we think the "Autofill" option is by far the best for any investors who don't want to research individual stocks: Index Investing. You might find it surprising to hear us Brians -- who love investing in individual stocks -- say it. But there's nothing wrong with owning an S&P 500 ETF. It's the right choice for most investors. Over the long run, it will very likely provide the financial returns you're looking for. And for most people, that's more than good enough. - Brian Feroldi, Brian Stoffel, & Brian Withers One Simple Graphic: One Piece of Timeless Content: The Fintech industry is eliminating the need for banks to have brick-and-mortar locations. The trend of digital commerce and e-banking is creating exciting opportunities for investors, but where to start? This Fintech primer is a great way to understand the trend towards a "cashless" society. One Thread:

One Resource: Compounding Quality is one of our favorite follows on Twitter and LinkedIn...but did you know he also produces a fantastic newsletter? It's filled with investing lessons, company deep dives, and timeless investing content. I highly recommend you sign up for it. One Quote: 👋 LAST WORD How are we doing? We love hearing from readers and are always looking for feedback. How are we doing? Is there anything you'd like to see more of or less of? What aspects of this newsletter do you enjoy the most? Just hit reply and say hello – we'd love to hear from you! More From Us: 📗 If you've read Brian Feroldi's book, he'd love a review. 👨🎓 The next cohort of our Valuation Explained Simply course starts in May! Click here for details. 🎬 Want a review of popular company earnings? Check out our YouTube channel! Last week, Brian Feroldi did a deep dive into Reddit's IPO. |

Long-Term Mindset

I teach investors how to analyze businesses. Each Wednesday, I share six pieces of timeless content that can be read in less than 2 minutes. Read by 100,000+ investors from a16z, Amazon, Google, Microsoft, and more.

View Online | Sign Up | Advertise Welcome to Long-Term Mindset, the Wednesday newsletter that helps you invest better. Today's Issue Read Time: <2 minutes Lesson: Why emergency funds are so important Timeless Content: Top cybersecurity companies analyzed Thread: How to bullet-proof your finances Resource: S&P 500 P/E Ratios And more! Together with Finchat Brian Feroldi using Finchat A good chart can relay information 10x faster than text alone. That's why I've become a power user of Finchat....

View Online | Sign Up | Advertise Welcome to Long-Term Mindset, the Wednesday newsletter that helps you invest better. Today's Issue Read Time: <2 minutes Lesson: When the world changes Timeless Content: The future of transportation Thread: Learning from master investors Resource: Mr. Money Mustache talks with the Mad Fientist And more! Sponsored by: SureDividend The Dividend Kings | The Best-Of-The-Best Dividend Stocks Thousands of publicly traded companies have a dividend – that means they...

View Online | Sign Up | Advertise Welcome to Long-Term Mindset, the Wednesday newsletter that helps you invest better. Today's Issue Read Time: <2 minutes Lesson: The importance of valuation Timeless Content: Morgan Housel and Howard Marks talk debt Thread: Understanding margin of safety Resource: A free summary of Warren Buffett's investing lessons And more! Learn how to value companies like the pros: Warren Buffett. Peter Lynch. Terry Smith. Stanley Druckenmiller. All of these legends know...