🧠 Why Amazon's Slow Growth Doesn't Matter

View Online | Sign Up | Advertise

Welcome to Long-Term Mindset, the Wednesday newsletter that helps you invest better.

Today's Issue Read Time: <3 minutes

- Lesson: Extroverts and investing

- Timeless Content: How much do you need for retirement?

- Thread: Powerful investing visuals every investor should know

- Resource: Think you are ready to buy a house?

- And more!

Together With SHMONEY

You're an amazing entrepreneur! But are you making as much as you could?

Let us teach you how to transform your content and offers into money-multiplying machines.

Subscribe to my newsletter, SHMONEY, and get real-world insights and reflections on generating and keeping money as a boss and a creator.

I can't wait to show up in your inbox every Wednesday & Sunday!

~Rachel Rodgers, Author We Should All Be Millionaires

| Yes, I want to subscribe! |

Friends,

Last week, Amazon reported earnings. Sales were up 13% -- which is solid, but not eye-popping. And yet, the stock zoomed ahead by as much as 9% following the release.

To some, this might be confusing. But peek underneath the hood and it makes much more sense:

For over a decade now, Amazon has been transitioning away from selling first-party goods (think: Amazon-branded toilet paper), and towards third-party goods (think: Cottonelle toilet paper sold on Amazon's site).

That transition has led to slower top line growth, but faster botton line growth. How could that be? Let's use the toilet-paper as a hypothetical example:

- Amazon pays $1.75 for its toilet paper to be made. It sells it for $2.00 -- pocketing $0.25 for itself. It then uses its own fulfillment netowrk to deliver the toilet paper.

- Cottonelle sells a roll of toilet paper for $2.50 and keeps that money. However, it pays a fee of $0.50 to Amazon for warehousing and delivering the toilet paper.

In the first example Amazon has $2.00 in sales, but only $0.25 in gross profit. In the second example, Amazon records just $0.50 in sales, but keeps it all as gross profit.

This is a huge oversimplification of what's happening at Amazon, but it highlights the dynamics. Amazon is giving up its own sales and allowing merchants to use all of the tools it has already built (and paid for) for higher-margin revenue.

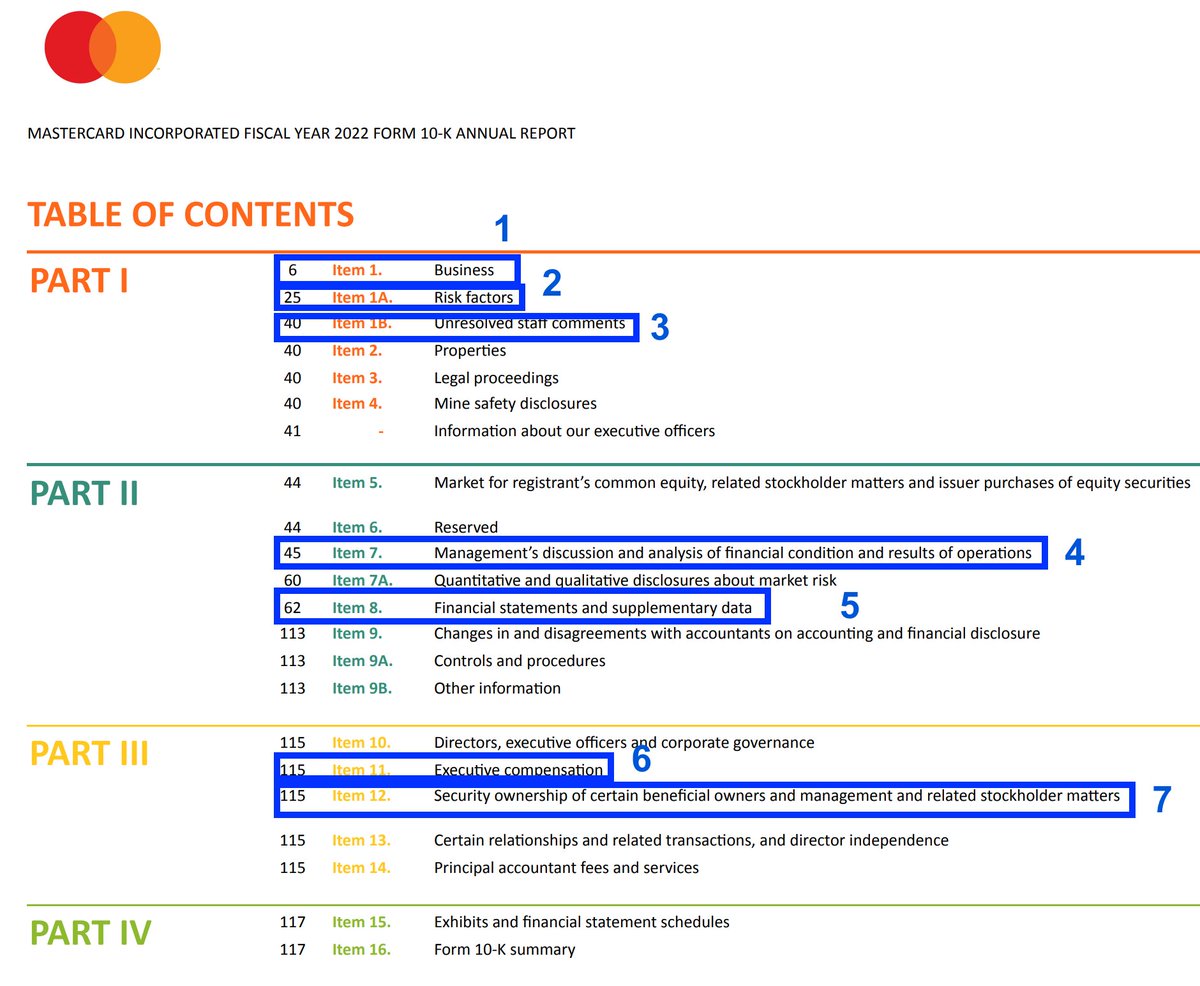

While both are growing, 3rd-party services is growing twice as fast, as this image from Finchat.io shows.

Investors who understand this dynamic are not only not worried about slower revenue growth -- they actually rejoice in it. In this case, it means more profits and a higher stock price.

But it takes time to understand the dynamics at play with each company, which is why we encourage you to get as familiar as possible with your own holdings. Over course, you can only do that if you're a long-term investor -- which is exactly what we encourage via this newsletter.

Wishing you investing success,

- Brian Feroldi, Brian Stoffel, & Brian Withers

P.S. -- We're hosting a free investing webinar on Wednesday, February 14th, at 12:00 PM EST. The topic: 10 Metrics Every Investor Must Know. We'll cover the metrics, show you how to find them, and how to analyze them - fast.

Click here to register instantly! All registered guests will be sent a replay.

One Simple Graphic:

One Piece of Timeless Content:

This piece from Morgan Housel, written over a decade ago, is still quite relevant today. It covers 50 reasons why we are living in the greatest period in history.

One Thread:

|

One Resource:

Quarterly, JP Morgan updates their Guide to the Markets document. It's an in-depth look at market sector performance, valuations, and many other key economic metrics. It's a good perspective on the overall economy and equity valuations.

One Quote:

More From Us:

📗 If you've read Brian Feroldi's book, he'd love a review.

👨🎓 The next cohort of our Advanced Financial Statment Analysis course starts in March! Click here to get on the list to learn more.

Long-Term Mindset

I teach investors how to analyze businesses. Each Wednesday, I share six pieces of timeless content that can be read in less than 2 minutes. Read by 100,000+ investors from a16z, Amazon, Google, Microsoft, and more.

View Online | Sign Up | Advertise Welcome to Long-Term Mindset, the Wednesday newsletter that helps you invest better. Today's Issue Read Time: <2 minutes Lesson: The #1 Tool for the Age of AI Timeless Content: How to Make Money in Real Estate Thread: Dollar Cost Averaging 101 Resource: What Is Artificial Super Intelligence? And more! Sponsored by: HubSpot Turn AI into Your Income Engine HubSpot’s groundbreaking guide "200+ AI-Powered Income Ideas" is your gateway to financial innovation in...

View Online | Sign Up | Advertise Welcome to Long-Term Mindset, the Wednesday newsletter that helps you invest better. Today's Issue Read Time: <2 minutes Lesson: Are we in a bubble? Timeless Content: Why "skin in the game" matters Thread: Why Individual Investors Have an Advantage Over Wall Street Resource: Advice for New Graduates in the Age of A.I. And more! Together with Fiscal.ai A good chart can relay information 10x faster than text alone. That's why I've become a power user of...

View Online | Sign Up | Advertise Welcome to Long-Term Mindset, the Wednesday newsletter that helps you invest better. Today's Issue Read Time: <2 minutes Lesson: Licking our wounds Timeless Content: Why "skin in the game" matters Thread: Why Individual Investors Have an Advantage Over Wall Street Resource: Advice for New Graduates in the Age of A.I. And more! Join Us For A Free Investing Masterclass: Join us next Tuesday (July 1st) for an investing masterclass: Five Moats Every Investor Must...