🧠 The Only Question That Matters With NVIDIA

|

View Online | Sign Up | Advertise Welcome to Long-Term Mindset, the Wednesday newsletter that helps you invest better. Today's Issue Read Time: <3 minutes

Together with Finchat I (Feroldi here) am a huge fan of visuals. A good chart can relay information 10x faster than numbers or text alone. That's why I've recently become a power user of Finchat. Finchat is a powerful tool that makes it easy to chart hundreds of business metrics with just a few clicks. This includes valuation metrics, financial metrics, analyst estimates, and even custom company KPIs like unit volumes, same-store sales, or even dollar-based net retention. Finchat also allows you to take advantage of cutting-edge AI, drastically speeding up my research process. Finchat is free to try, but the site is so useful that I happily pay for its premium features. Want to try it? Use this link to sign up and knock 25% off the annual price.

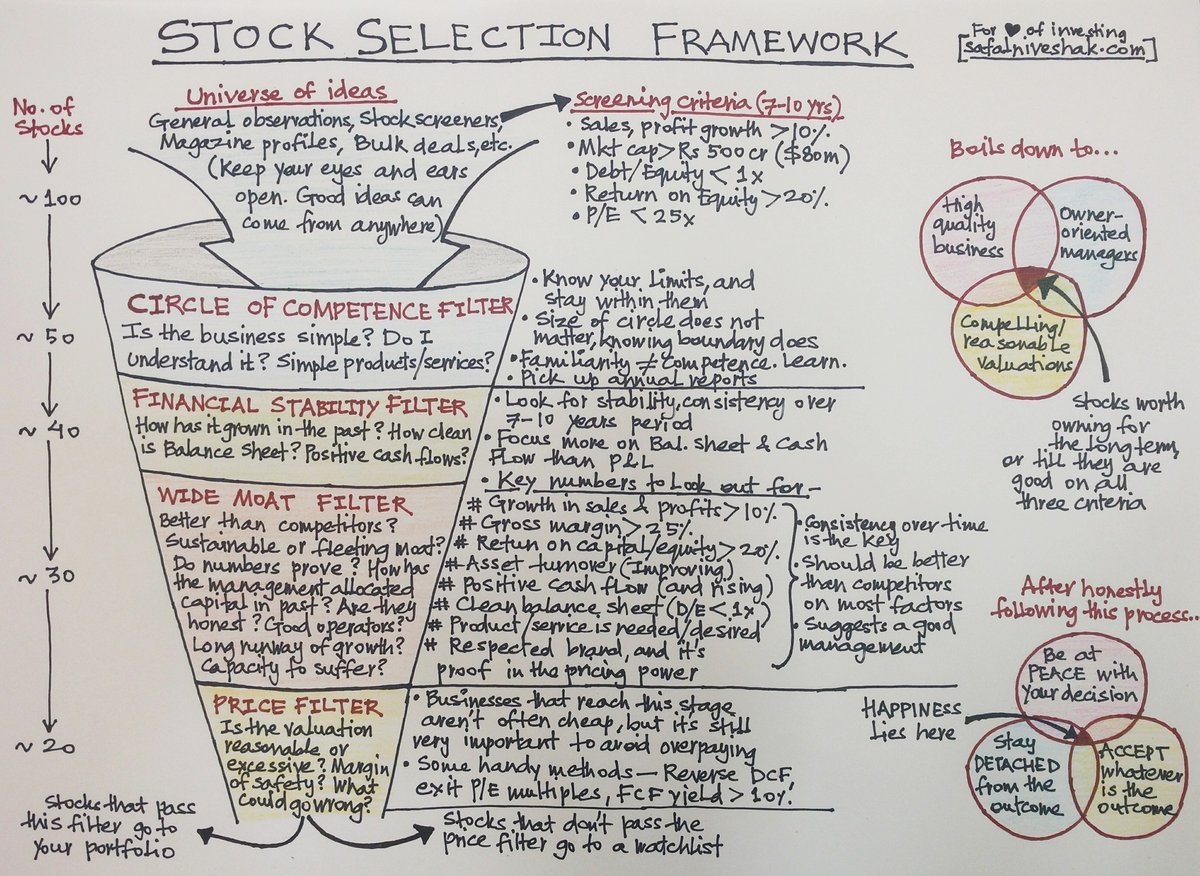

Friends, Let's revisit what's happened to NVIDIA over the past year...in Three Acts. Act I It's June 2023. NVIDIA shareholders are sitting pretty. Revenue is shrinking right now, but it won't be that way for long. ChatGPT was released eight months ago, and demand for NVIDIA's GPUs is expected to sky-rocket. With management's forecast for 64% growth in the second quarter, investors are tripping over themselves to buy shares. Since ChatGPT's release, the stock has tripled. NVIDIA is now a $1 trillion company. Act II Convinced NVIDIA can't possibly go any higher, many investors (ourselves included) stay on the sidelines. That's too bad: the 64% revenue growth management predicted was actually low-balling it (it came in at 70%). But that's not the real story. By the end of the year, NVIDIA is clocking revenue growth of 265%. Not only that, net profit margins were north of 50%! NVIDIA is selling the picks and shovels of the AI revolution -- and it's the only major vendor for the time being. The stock has doubled since Act I -- now a $2 billion company. Act III Act III is today. Instead of trying to predict where the stock will go, we can focus on a more fundamental question: Where are we on the AI-adoption S-curve? Every major technological breakthrough goes through a period of adoption. What seems like a small, niche product can go mainstream and explode overnight. We've seen this pattern repeatedly over the past century. The only question that NVIDIA (and Super MicroComputer, and AMD) investors should be asking themselves is this: Sadly, we don't have the answer to that question. But we are certain that this is the right question to be asking. We also firmly believe that over the long-run, knowing which questions to ask is even more important than your predictions about the future. Wise questions help inform the stocks you put in your portfolio, their allocations, and -- in the end -- your overall returns. Wishing you investing success and a future full of beautifully wise questions, - Brian Feroldi, Brian Stoffel, & Brian Withers One Simple Graphic: One Piece of Timeless Content: The Warren Buffett Way by Robert Hagstrom is a classic investing book. If you've never read it, check out this 8-page summary. It contains a quick overview of Buffett's approach to investing. I love point #1 the most: "Never follow the day-to-day fluctuations of the stock market." One Thread:

One Resource: With Nvidia's stellar stock performance over the year, investors have become interested in the industry. If you fall into that camp, you should check out this microchip investing overview. One Quote: 👋 LAST WORD How are we doing? We love hearing from readers and are always looking for feedback. How are we doing? Is there anything you'd like to see more of or less of? What aspects of this newsletter do you enjoy the most? Just hit reply and say hello – we'd love to hear from you! Cheers, More From Us: 📗 If you've read Brian Feroldi's book, he'd love a review. 👨🎓 The next cohort of our Valuation Explained Simply course starts in May! Click here for details. 🎬 Want a review of popular company earnings? Check out our YouTube channel! Last week, Brian Stoffel reviewed Crowdstrike's stellar results and covered why Sea Limited is investable again. |

Long-Term Mindset

I teach investors how to analyze businesses. Each Wednesday, I share six pieces of timeless content that can be read in less than 2 minutes. Read by 100,000+ investors from a16z, Amazon, Google, Microsoft, and more.

View Online | Sign Up | Advertise Welcome to Long-Term Mindset, the Wednesday newsletter that helps you invest better. Today's Issue Read Time: <2 minutes Lesson: Are we in a bubble? Timeless Content: Why "skin in the game" matters Thread: Why Individual Investors Have an Advantage Over Wall Street Resource: Advice for New Graduates in the Age of A.I. And more! Together with Fiscal.ai A good chart can relay information 10x faster than text alone. That's why I've become a power user of...

View Online | Sign Up | Advertise Welcome to Long-Term Mindset, the Wednesday newsletter that helps you invest better. Today's Issue Read Time: <2 minutes Lesson: Licking our wounds Timeless Content: Why "skin in the game" matters Thread: Why Individual Investors Have an Advantage Over Wall Street Resource: Advice for New Graduates in the Age of A.I. And more! Join Us For A Free Investing Masterclass: Join us next Tuesday (July 1st) for an investing masterclass: Five Moats Every Investor Must...

View Online | Sign Up | Advertise Welcome to Long-Term Mindset, the Wednesday newsletter that helps you invest better. Today's Issue Read Time: <2 minutes Lesson: America's greatest author Timeless Content: The state of the housing market Thread: Key SEC Statements for Investors Resource: Ray Dalio's All-Weather Portfolio And more! Sponsored by: Brain.fm Transform Your Focus With Brain.fm We know you’re always on the hunt for tools that genuinely improve your life—which is why we're excited...