🧠 Buffett's Hidden Super-Power

View Online | Sign Up | Advertise

Welcome to Long-Term Mindset, the Wednesday newsletter that helps you invest better.

Today's Issue Read Time: <3 minutes

- Lesson: Extroverts and investing

- Timeless Content: How much do you need for retirement?

- Thread: Powerful investing visuals every investor should know

- Resource: Think you are ready to buy a house?

- And more!

Today’s Newsletter is Brought to You by ConvertKit

Grow your email list passively

Add a new, passive list growth channel to your 2024 strategy with ConvertKit Recommendations. Set up your profile in the Creator Network and increase the chances of your content getting noticed and your subscriber list growing from recommendations of other creators— even when you’re out playing with your kids, grocery shopping, or setting up your next big launch. Just set it up and let it go.

| Start growing today |

Friends,

The Dot Com crash of 2000 was a tough period for investors.

Tech stocks crash. Venture funding dried up. Layoffs skyrocketed.

Yet, Warren Buffett was able to sit on the sidelines and avoid the carnage.

2008 was even worse. The entire market crashed. Unemployment skyrocketed. The government was forced to save us from a financial depression.

Yet again, Warren Buffett rose above the noise. He was like a kid in a candy store, buying bargains. He emerged from the crisis stronger than ever.

How does he consistently flourish during periods of market turmoil?

Susan Cain -- author of the best-selling book Quiet: The Power of Introverts in a World That Can't Stop Talking -- has a pretty good idea: He gets zero satisfaction from following the crowd.

We'd all like to believe we are the same: Jedi-Masters who can similarly tune out the world. In reality, we're fooling ourselves.

That's because up to 75% of the U.S. population is extroverted. In general, that's a good thing -- most of society is built around the extroverted ideal.

But does this have to do with investing?

Warren Buffett is introverted (and so are most of the world's greatest investors.)

How does that affect our investing? Here's what Cain has to say:

Does that mean that 75% of us who are extroverted are doomed to be terrible investors?

Not necessarily. But it does require us to acknowledge our blind spots. If you're an extrovert, you need to devise ways to slow your thinking down -- so that you make decisions from the analytical, not emotional, part of your brain. A few suggestions:

- Write: Journal your investing thesis behind a stock before hitting "Buy."

- Wait: Institute a 48-hour "cooling down" period between when you want to make a trade and when you do it.

- Talk: Discuss with someone why you'll be making a move before you do it.

These behaviors will seem inconsequential as you do them. But when you look back 30 years from now, you'll see they made all the difference.

Wishing you investing success,

- Brian Feroldi, Brian Stoffel, & Brian Withers

P.S. -- We're hosting a free investing webinar on Wednesday, February 14th, at 12:00 PM EST. The topic: 10 Metrics Every Investor Must Know. We'll cover the metrics, how to find them, and how to analyze them - fast. Click here to register instantly! All registered guests will be sent a replay.

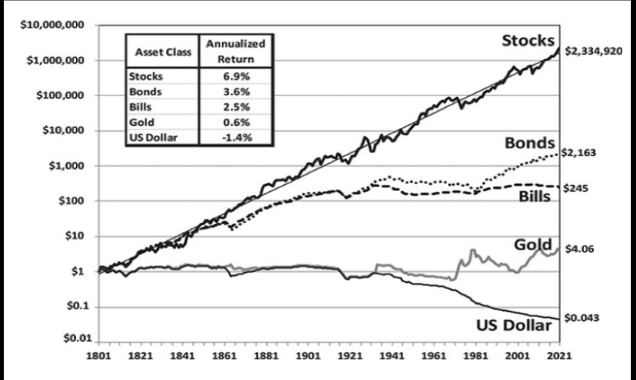

One Simple Graphic:

One Piece of Timeless Content:

Katie Gatti Tassin, the face and voice of Money with Katie, shares her rule of thumb to determine how much you need to save for retirement. This guidance can also double as a budgeting tool to determine if that tasty Pistachio Frappuccino should become a regular habit.

One Thread:

|

One Resource:

Ramit Sethi, author of I Will Teach You to Be Rich, doesn't take home ownership lightly. Here are his 5 rules to determine if you are ready to take the plunge to a house.

One Quote:

More From Us:

📗 If you've read Brian Feroldi's book, he'd love a review.

👨🎓 The next cohort of our Advanced Financial Statment Analysis course starts in March! Click here to get on the list to learn more.

Long-Term Mindset

I teach investors how to analyze businesses. Each Wednesday, I share six pieces of timeless content that can be read in less than 2 minutes. Read by 100,000+ investors from a16z, Amazon, Google, Microsoft, and more.

View Online | Sign Up | Advertise Welcome to Long-Term Mindset, the Wednesday newsletter that helps you invest better. Today's Issue Read Time: <2 minutes Lesson: Are we in a bubble? Timeless Content: Why "skin in the game" matters Thread: Why Individual Investors Have an Advantage Over Wall Street Resource: Advice for New Graduates in the Age of A.I. And more! Together with Fiscal.ai A good chart can relay information 10x faster than text alone. That's why I've become a power user of...

View Online | Sign Up | Advertise Welcome to Long-Term Mindset, the Wednesday newsletter that helps you invest better. Today's Issue Read Time: <2 minutes Lesson: Licking our wounds Timeless Content: Why "skin in the game" matters Thread: Why Individual Investors Have an Advantage Over Wall Street Resource: Advice for New Graduates in the Age of A.I. And more! Join Us For A Free Investing Masterclass: Join us next Tuesday (July 1st) for an investing masterclass: Five Moats Every Investor Must...

View Online | Sign Up | Advertise Welcome to Long-Term Mindset, the Wednesday newsletter that helps you invest better. Today's Issue Read Time: <2 minutes Lesson: America's greatest author Timeless Content: The state of the housing market Thread: Key SEC Statements for Investors Resource: Ray Dalio's All-Weather Portfolio And more! Sponsored by: Brain.fm Transform Your Focus With Brain.fm We know you’re always on the hunt for tools that genuinely improve your life—which is why we're excited...