🧠 An Investing Lesson from Monday Night Football

|

View Online | Sign Up | Advertise Welcome to Long-Term Mindset, the Wednesday newsletter that helps you invest better. Today's Issue Read Time: <3 minutes

Friends, Few athletes were as celebrated in the early 1980s as Joe Thiesmann. In 1982, he led Washington to its first Super Bowl win in 40 years. He followed that up by leading his team to the Big Game again the next year. Theismann collected a Most Valuable Player (MVP) award along the way. But it all ended on November 18, 1985. That's when Lawrence Taylor sacked Thiesmann and broke multiple bones in his leg before a nationwide audience on Monday Night Football. Our question to you: How large of a contract would you have offered Theismann to come to play for your team the next year? Hopefully, the answer is clear: NOTHING! He could barely walk. Now, let's fast-forward 39 years to last week. Cybersecurity firm Palo Alto reported earnings. Both revenue and profits came in ahead of expectations. The market's reaction: the stock fell over 25%. This was truly confounding to some. We made a YouTube video on it and got comments like this: There are two potential reactions to this:

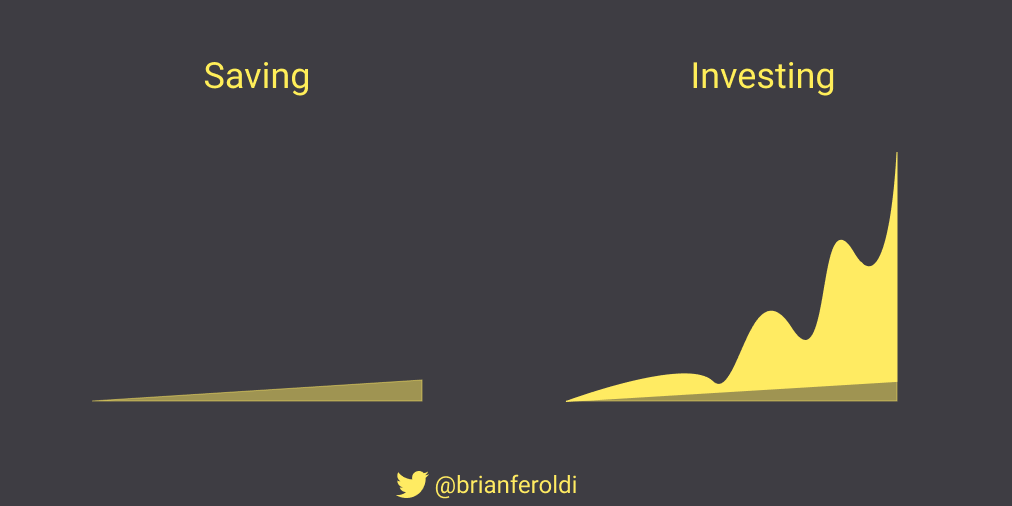

Think about it. If all I told you was what Joe Theismann accomplished before that fateful November night, you could have understandably argued for a huge contract. But once you knew about the injury, you could throw it all out the window. The same dynamic is true in the stock market. As it turns out, Palo Alto warned that its sales growth would be notably slower over the course of the next year than expected. It will be giving away a lot of its products for free in order to win customers over. That's not a great sign. All of this underscores why investing is hard. Even when the headline numbers look good, the market can react negatively to something that isn't immediately obvious. This is why we believe the only way for individuals to win in the stock market is to invest with a long-term mindset. Trying to guess the near-term movements of a stock isn't a game that's winnable. Professional traders have faster computers and better information than you'll ever have. However, they can't invest for the long-term, but individual investors can. It's your biggest advantage. Don't waste it. Wishing you investing success, - Brian Feroldi, Brian Stoffel, & Brian Withers P.S. -- Registration is still open for our newest course: Advanced Financial Statement Analysis. Click here to register. Use the code LASTCALL200 for a nice discount. But hurry: this offer expires this Sunday at 11:59 PM EST. One Simple Graphic: One Piece of Timeless Content: Morgan Housel is one of our favorite financial writers. His post titled The Thin Line Between Bold and Reckless reminds us that business disruptions are sometimes illegal; think Tesla's refusal to sell into car dealerships. And that only years later do these disruptions become acceptable practice. One Thread:

One Resource: Interested in dividends but not interested in researching individual dividend stocks? Dividend ETFs might be for you. This article covers 8 Dividend ETFs for you to consider. One Quote: More From Us: 📗 If you've read Brian Feroldi's book, he'd love a review. 👨🎓 The next cohort of our Advanced Financial Statment Analysis course starts in March! Enrollment is open now! Click here for details. |

Long-Term Mindset

I teach investors how to analyze businesses. Each Wednesday, I share six pieces of timeless content that can be read in less than 2 minutes. Read by 100,000+ investors from a16z, Amazon, Google, Microsoft, and more.

View Online | Sign Up | Advertise Welcome to Long-Term Mindset, the Wednesday newsletter that helps you invest better. Today's Issue Read Time: <2 minutes Lesson: The #1 Tool for the Age of AI Timeless Content: How to Make Money in Real Estate Thread: Dollar Cost Averaging 101 Resource: What Is Artificial Super Intelligence? And more! Sponsored by: HubSpot Turn AI into Your Income Engine HubSpot’s groundbreaking guide "200+ AI-Powered Income Ideas" is your gateway to financial innovation in...

View Online | Sign Up | Advertise Welcome to Long-Term Mindset, the Wednesday newsletter that helps you invest better. Today's Issue Read Time: <2 minutes Lesson: Are we in a bubble? Timeless Content: Why "skin in the game" matters Thread: Why Individual Investors Have an Advantage Over Wall Street Resource: Advice for New Graduates in the Age of A.I. And more! Together with Fiscal.ai A good chart can relay information 10x faster than text alone. That's why I've become a power user of...

View Online | Sign Up | Advertise Welcome to Long-Term Mindset, the Wednesday newsletter that helps you invest better. Today's Issue Read Time: <2 minutes Lesson: Licking our wounds Timeless Content: Why "skin in the game" matters Thread: Why Individual Investors Have an Advantage Over Wall Street Resource: Advice for New Graduates in the Age of A.I. And more! Join Us For A Free Investing Masterclass: Join us next Tuesday (July 1st) for an investing masterclass: Five Moats Every Investor Must...