🧠 The Importance of Earnings

|

View Online | Sign Up | Advertise Welcome to Long-Term Mindset, the Wednesday newsletter that helps you invest better. Today's Issue Read Time: <3 minutes

Friends, Tell us if you've heard this pithy line before: If you missed the best 30 days of stock market returns over the past three decades, your returns would have been obliterated. There's data to back that up. Here's the evidence Hartford Funds offered its clients. The spirit of this message is on point: don't sell when there's volatility. But beginner investors walk away missing two very important caveats:

Here's the missing piece for long-term investors: nothing drives stock prices more than results. Investors also get the most information about results during earnings season. Thus, if you're looking for a time when your investments will gradually become decoupled from the market—in a good way—look no further than earnings season. We don't think anyone should freak out or rejoice over one earnings report, but we do think this is where there is real evidence that can battle-test your original investing thesis. Wishing you investing success, - Brian Feroldi, Brian Stoffel, & Brian Withers P.S. Need help analyzing a company's quarterly results? Check out this YouTube video we made on how we review quarterly earnings. One Simple Graphic: One Piece of Timeless Content: Morgan Housel helps investors develop a beneficial mindset about investing in an easy-to-understand and memorable way. In one of his recent blog posts, Lucky versus Repeatable, he defines luck in a way you've never thought about before and ties it to investing. One Thread:

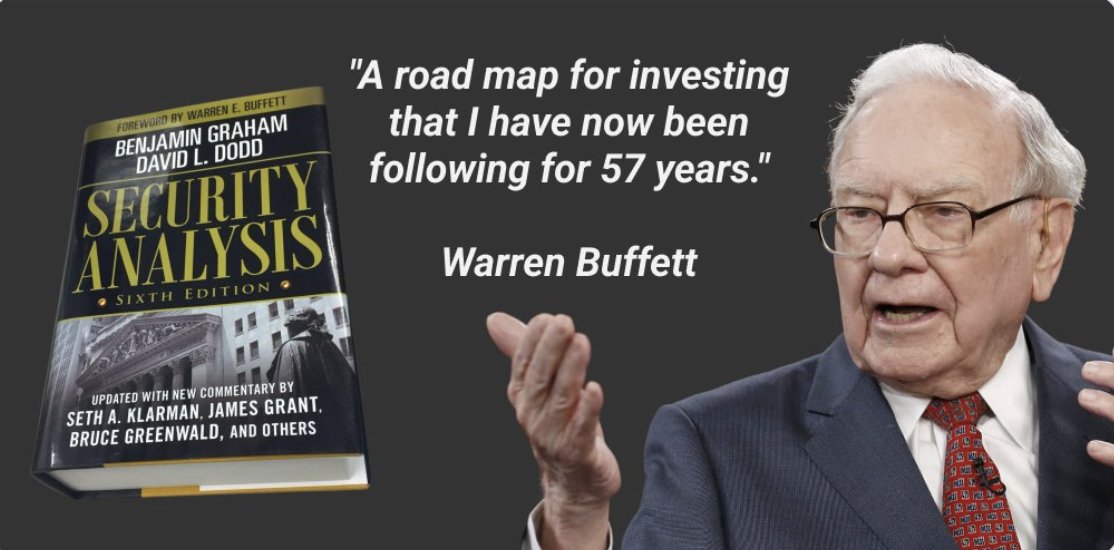

One Resource: Did you miss the Berkshire Hathaway shareholder meeting? It was live-streamed on CNBC, along with an article that included live updates of the most interesting moments of the five-plus-hour Q&A session. One Quote: 👋 What did you think of today's newsletter? More From Us: 📗 If you've read Brian Feroldi's book, he'd love a review. 👨🎓 Interested in learning to read financial statements like Warren Buffett? Check out our self-paced course, The Buffett Method. 🎬 Want a review of popular company earnings? Check out our YouTube channel! Cloudflare, Apple, & MercadoLibre earnings videos are now available! |

Long-Term Mindset

I teach investors how to analyze businesses. Each Wednesday, I share six pieces of timeless content that can be read in less than 2 minutes. Read by 100,000+ investors from a16z, Amazon, Google, Microsoft, and more.

View Online | Sign Up | Advertise Welcome to Long-Term Mindset, the Wednesday newsletter that helps you invest better. Today's Issue Read Time: <2 minutes Lesson: The #1 Tool for the Age of AI Timeless Content: How to Make Money in Real Estate Thread: Dollar Cost Averaging 101 Resource: What Is Artificial Super Intelligence? And more! Sponsored by: HubSpot Turn AI into Your Income Engine HubSpot’s groundbreaking guide "200+ AI-Powered Income Ideas" is your gateway to financial innovation in...

View Online | Sign Up | Advertise Welcome to Long-Term Mindset, the Wednesday newsletter that helps you invest better. Today's Issue Read Time: <2 minutes Lesson: Are we in a bubble? Timeless Content: Why "skin in the game" matters Thread: Why Individual Investors Have an Advantage Over Wall Street Resource: Advice for New Graduates in the Age of A.I. And more! Together with Fiscal.ai A good chart can relay information 10x faster than text alone. That's why I've become a power user of...

View Online | Sign Up | Advertise Welcome to Long-Term Mindset, the Wednesday newsletter that helps you invest better. Today's Issue Read Time: <2 minutes Lesson: Licking our wounds Timeless Content: Why "skin in the game" matters Thread: Why Individual Investors Have an Advantage Over Wall Street Resource: Advice for New Graduates in the Age of A.I. And more! Join Us For A Free Investing Masterclass: Join us next Tuesday (July 1st) for an investing masterclass: Five Moats Every Investor Must...